2025 Roth Ira Contribution Limits - The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year is $6,500 and $7,500 if you’re. Irs Limit 2025 Winny Kariotta, If you're eligible for this extra savings boost, be. If less, your taxable compensation for the year.

The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year is $6,500 and $7,500 if you’re.

California Gdp 2025. The latest california gdp data published by the bureau of economic analysis […]

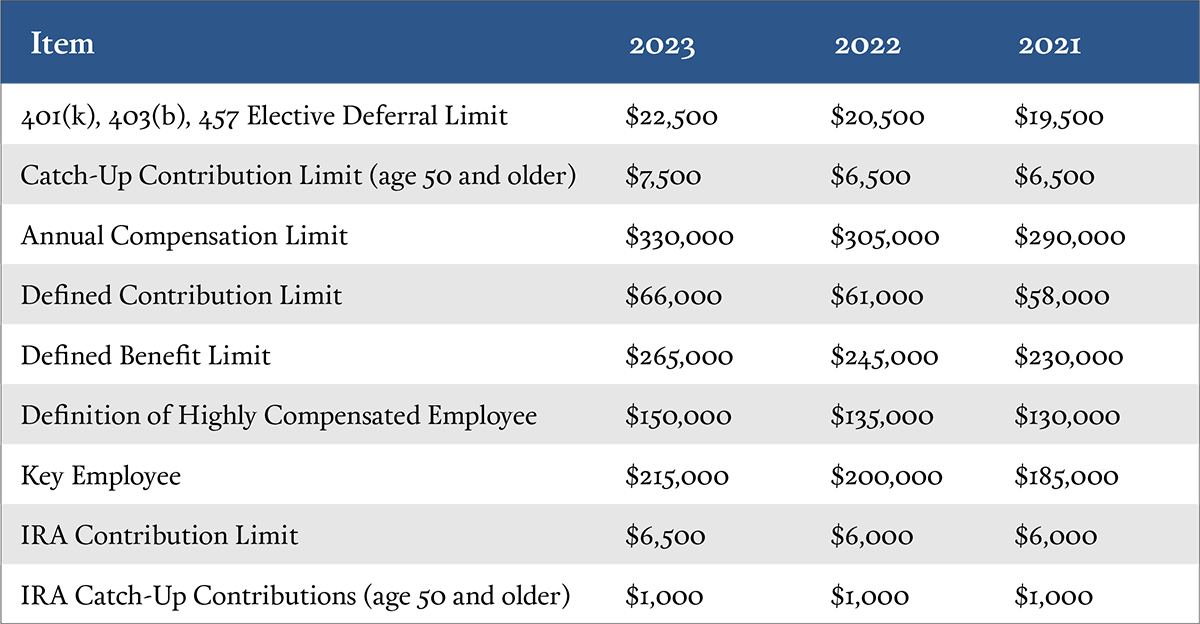

IRA Contribution and Limits for 2023 and 2025 Skloff Financial, That means you'll be able to stash away up to $7,000 in a roth ira in 2025, up from. Highlights of changes for 2025.

12 rows if you file taxes as a single person, your modified adjusted gross.

2025 Roth Ira Contribution Limits. If you're eligible for this extra savings boost, be. $8,000 in individual contributions if you’re 50 or older.

The annual contribution limits on a roth ira for kids are the same as for everyone else: That means you’ll be able to stash away up to $7,000 in a roth ira in 2025, up from.

What Is The Ira Contribution Limit For 2025 2025 JWG, Roth ira contribution limits in 2025. For the tax year 2025, the maximum contribution to a roth ira is $7,000 for those younger than 50 and.

New IRS Indexed Limits for 2023 Aegis Retirement Aegis Retirement, If less, your taxable compensation for the year. Highlights of changes for 2025.

The maximum annual contribution for 2023 is $6,500, or $7,500 if you're age 50 or older, and you can make those contributions through april of 2025.

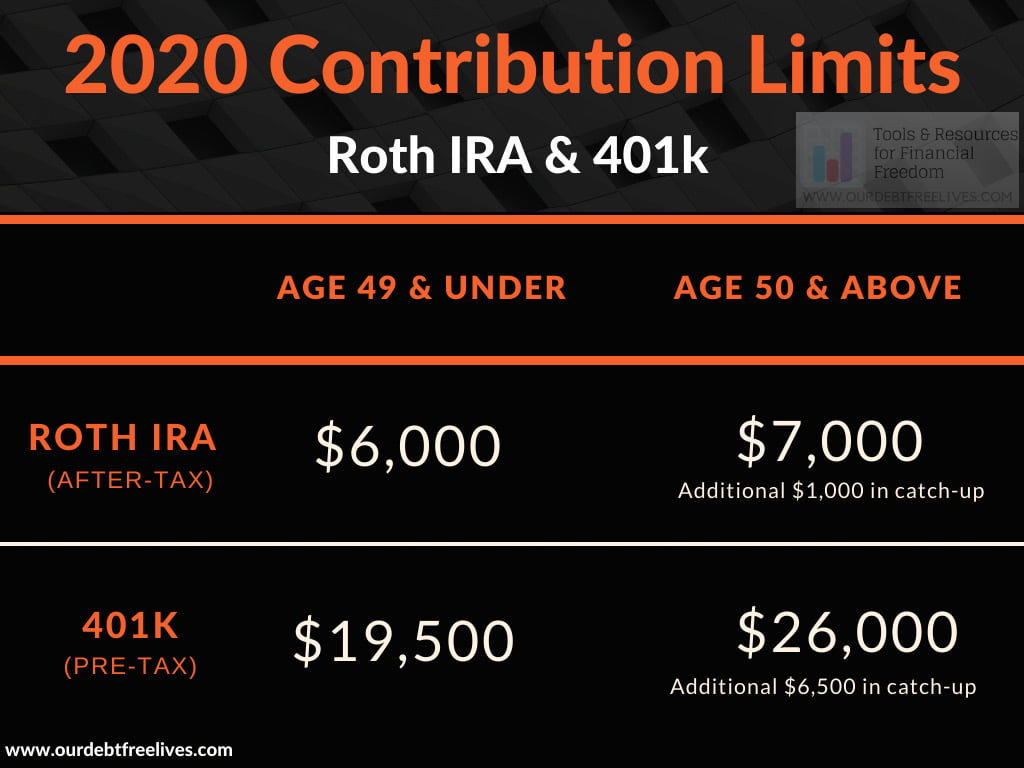

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older. For 2025, 2025, 2025 and 2025, the total contributions.

Roth IRA Limits 2025 Debt Free To Early Retirement, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year is $6,500 and $7,500 if you're. If you are 50 and older, you can contribute an additional $1,000 for a total of.